US market closed higher. Dow and S&P closed with a historic high.

Harpex, BDI, CDFI, and CCFI closed higher.

The dollar index closed higher with an inside day.

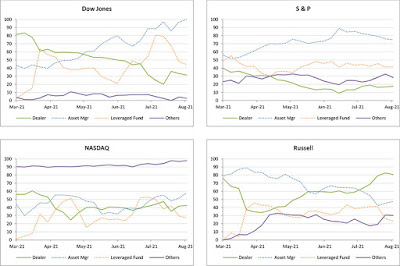

Instruments that show buying interest (3) from Dealer/Intermediary (sell-side participants)

UT

Instruments that show selling interest at extreme (2) by Dealer/Intermediary (sell-side participants)

UT

- None

- Russell

- None

Instruments that show selling interest at extreme (2) by Dealer/Intermediary (sell-side participants)

UT

- None

- None

- None

Note

(1) COT Index >= 90, Buying interest at extreme

(2) COT Index <= 10, Selling interest at extreme

(3) COT Index >= 70, rising COT Index, monitor for trend reversal

Down Trend and Up Trend is based on 50 Simple Moving Average(2) COT Index <= 10, Selling interest at extreme

(3) COT Index >= 70, rising COT Index, monitor for trend reversal

Dow

Daily UT, Weekly UT

Potential resistance around 35,495

Potential resistance around 35,495

Potential support around 33,365, 31,236, 29,407, 29,106, 28,912

S&P

Daily UT, Weekly UT

Daily UT, Weekly UT

Potential resistance around 4,632

Potential support around 4,396, 4,161, 3,925, 3,690, 3,579, 3,454

Nasdaq

Daily UT, Weekly UT

Potential resistance around 15,652

Potential support around 114,930, 4,207, 13,485, 12,762, 12,410, 12,040

Russell

Daily Neutral, Weekly UT

Potential resistance around 2,300, 2,430, 2,561

Daily Neutral, Weekly UT

Potential resistance around 2,300, 2,430, 2,561

Potential support around 2,170, 2,040, 1,910, 1,779, 1,743, 1,708

Key event to watch out for (SG Time, GMT+8)

09 Aug, Mon

- Japan and Singapore Holiday

- 0930 China Consumer Price Index (YoY)

- 2200 US JOLTs Job Openings (Jun)

10 Aug, Tue

- 0750 Japan Current Account n.s.a.

- 1700 German ZEW Economic Sentiment (Aug)

11 Aug, Wed

- 1400 German Harmonized Index of Consumer Prices (YoY)

- 2030 US Core CPI (MoM) (Jul)

- 2230 US Crude Oil Inventories

12 Aug, Thu

- 1400 UK GDP Q2

- 1400 UK Manufacturing Production (MoM) (Jun)

- 2030 US Initial Jobless Claims

- 2030 US PPI (MoM) (Jul)

13 Aug, Fri

- 0930 Australia Employment Change (Jul)

- 2200 US Michigan Consumer Sentiment Index

No comments:

Post a Comment