On the weekly chart, the Dollar Index broke lhf and closed higher. Dollar Index continues to consolidate.

Resistance at 102.3, 106.7, 109.7

Support at 100.3, TLU1, 99.8, 98.7, TLU4, 97.3, TLD1, 96.3, 95.0

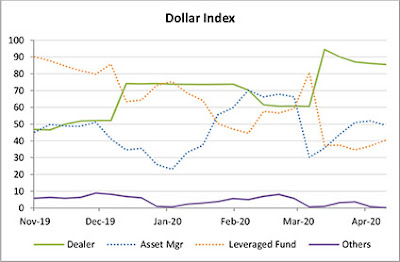

COT for Dollar Index

Weekly chart with 50 SMA

Sunday, April 26, 2020

Commodities Update 25 Apr 2020

BDI decreased from 751 (17 Apr) to 665 (24 Apr)

Harpex decreased again, from 601.46 (10 Apr) to 573.83 (17 Apr)

Harpex decreased again, from 601.46 (10 Apr) to 573.83 (17 Apr)

COT

Note

(1) COT Index >= 90, Buying interest at extreme

(2) COT Index <= 10, Selling interest at extreme

(3) COT Index >= 70, rising COT Index, monitor for trend reversal

Down Trend and Up Trend is based on 50 Simple Moving Average

Download Commodities COT

Instruments that show buying interest (3) by Producer/Merchant/Processor/User

Down Trend

Instruments that show buying interest (3) by Producer/Merchant/Processor/User

Down Trend

- Corn

- Soybean Oil

- Natural Gas (1)

- Feeder Cattle

- Copper

- Palladium (1)

- Lumber

- Cotton

Neutral

- None

Up Trend

- None

Instruments that show selling interest at extreme (2) only by Producer/Merchant/Processor/User

Up Trend

Up Trend

- None

- None

Down Trend

- None

Note

(1) COT Index >= 90, Buying interest at extreme

(2) COT Index <= 10, Selling interest at extreme

(3) COT Index >= 70, rising COT Index, monitor for trend reversal

Down Trend and Up Trend is based on 50 Simple Moving Average

US Market 25 Apr 2020

US market closed lower except for Russell closed higher.

Dow broke pwl and closed lower with a -roc. Nasdaq broke pwh and closed lower with a +roc. S&P and Russell closed with a +roc inside day.

BDI and Harpex closed lower.

Dollar Index continues to consolidate.

Instruments that show buying interest (3) from Dealer/Intermediary (sell-side participants)

UT

Instruments that show selling interest at extreme (2) by Dealer/Intermediary (sell-side participants)

UT

Dow

S&P

Daily DT, Weekly DT

Nasdaq

Daily DT, Weekly UT

Russell

Daily DT, Weekly DT

Potential resistance around 1,240, 1,259, 1,287, 1,296, 1,341, 1,388, 1,420

27 Apr, Mon

Dow broke pwl and closed lower with a -roc. Nasdaq broke pwh and closed lower with a +roc. S&P and Russell closed with a +roc inside day.

BDI and Harpex closed lower.

Dollar Index continues to consolidate.

Instruments that show buying interest (3) from Dealer/Intermediary (sell-side participants)

UT

- None

- None

- Dow (1)

- S&P (1)

- Russell (1)

Instruments that show selling interest at extreme (2) by Dealer/Intermediary (sell-side participants)

UT

- None

- None

- None

(1) COT Index >= 90, Buying interest at extreme

(2) COT Index <= 10, Selling interest at extreme

(3) COT Index >= 70, rising COT Index, monitor for trend reversal

Down Trend and Up Trend is based on 50 Simple Moving Average(2) COT Index <= 10, Selling interest at extreme

(3) COT Index >= 70, rising COT Index, monitor for trend reversal

Dow

Daily DT, Weekly DT

Potential resistance around 24,170, 24,837, 25,326, 25,645, 25,784, 26,245, 26,627

Potential resistance around 24,170, 24,837, 25,326, 25,645, 25,784, 26,245, 26,627

Potential support around 23,567, 23,435, 23,175, 22,776, 22,121, 22,027, 21,659, 21,099

S&P

Daily DT, Weekly DT

Potential resistance around 2,854, 2,874, 2,940, 2,983, 3,022, 3,072, 3,155, 3,219

Potential support around 2,825, 2,814, 2,786, 2,747, 2,710, 2,593, 2,551, 2,506, 2,480

Nasdaq

Daily DT, Weekly UT

Potential resistance around 8,781, 9,243, 9,653, 9,723, 9,873, 10,595

Potential support around 8,428, 8,196, 8,002, 7,859, 7,706, 7,516, 7,282, 7,134

Russell

Daily DT, Weekly DT

Potential resistance around 1,240, 1,259, 1,287, 1,296, 1,341, 1,388, 1,420

Potential support around 1,213, 1,185, 1,164, 1,137, 1,114, 1,095

Key event to watch out (SG Time, GMT+8)

- New Zealand holiday

- 0930 China PBoC Loan Prime Rate

- 1100 Japan BoJ Monetary Policy Statement

- 1100 Japan BoJ Outlook Report (YoY)

- 1100 Japan BoJ Interest Rate Decision

- 1400 Japan BoJ Press Conference

- 1600 Europe ECB Bank Lending Survey

- 2030 US Goods Trade Balance

- 2200 US CB Consumer Confidence (Apr)

- Japan Holiday

- 0645 New Zealand Employment Change (QoQ) (Q1)

- 0930 Australia CPI (QoQ) (Q1)

- 2000 German Harmonized Index of Consumer Prices (YoY)

- 2030 US GDP (QoQ) (Q1)

- 2200 US Pending Home Sales (MoM) (Mar)

- 2230 US Crude Oil Inventories

- Hong Kong holiday

- 0200 US FOMC Statement

- 0200 US Fed Interest Rate Decision

- 0230 US FOMC Press Conference

- 0750 Japan Industrial Production (YoY)

- 0900 China Manufacturing PMI (Apr)

- 1555 German Unemployment Change (Apr)

- 1700 Europe Gross Domestic Product s.a. (YoY)

- 1700 Europe Unemployment Rate

- 1700 Europe CPI (YoY) (Apr)

- 1900 Europe Deposit Facility Rate (Apr)

- 1900 Europe ECB Monetary Policy Statement

- 1900 Europe ECB Interest Rate Decision

- 2030 US Initial Jobless Claims

- 2030 Canada GDP (MoM) (Feb)

- 2030 Europe ECB Press Conference

- Most countries in Asia and Europe are having public holiday

- 0830 Australia Producer Price Index (YoY)

- 1600 UK Manufacturing PMI (Apr)

- 2030 US Average Hourly Earnings (YoY)

- 2200 US ISM Manufacturing PMI (Apr)

Sunday, April 19, 2020

Dollar index consolidating

On the weekly chart, the Dollar Index broke hlf and recovered to close higher. Dollar Index consolidating since mid of Mar.

Resistance at TLU1, 100.3, 102.3, 106.7, 109.7

Support at 99.8, 98.7, TLU4, 98.7, 97.3, TLD1, 96.3, 95.0

COT for Dollar Index

Weekly chart with 50 SMA

Resistance at TLU1, 100.3, 102.3, 106.7, 109.7

Support at 99.8, 98.7, TLU4, 98.7, 97.3, TLD1, 96.3, 95.0

COT for Dollar Index

Weekly chart with 50 SMA

Commodities Update 18 Apr 2020

BDI increased to 751 (17 Apr) from 635 (09 Apr)

Harpex decreased for another week, from 613.09 (03 Apr) to 601.46 (10 Apr)

COT

Note

(1) COT Index >= 90, Buying interest at extreme

(2) COT Index <= 10, Selling interest at extreme

(3) COT Index >= 70, rising COT Index, monitor for trend reversal

Down Trend and Up Trend is based on 50 Simple Moving Average

Harpex decreased for another week, from 613.09 (03 Apr) to 601.46 (10 Apr)

COT

Download Commodities COT

Instruments that show buying interest (3) by Producer/Merchant/Processor/User

Down Trend

Instruments that show buying interest (3) by Producer/Merchant/Processor/User

Down Trend

- Corn

- Soybean Oil

- Natural Gas (1)

- Feeder Cattle

- Copper

- Palladium (1)

- Lumber

- Cotton

Neutral

- None

Up Trend

- None

Instruments that show selling interest at extreme (2) only by Producer/Merchant/Processor/User

Up Trend

Up Trend

- None

- None

Down Trend

- None

Note

(1) COT Index >= 90, Buying interest at extreme

(2) COT Index <= 10, Selling interest at extreme

(3) COT Index >= 70, rising COT Index, monitor for trend reversal

Down Trend and Up Trend is based on 50 Simple Moving Average

US Market 18 Apr 2020

US market closed higher except for Russell closed lower with a small roc.

BDI closed higher while Harpex closed lower.

Dollar Index consolidating since mid of Mar.

Instruments that show buying interest (3) from Dealer/Intermediary (sell-side participants)

UT

Instruments that show selling interest at extreme (2) by Dealer/Intermediary (sell-side participants)

UT

Dow

S&P

Daily DT, Weekly DT

Nasdaq

Daily DT, Weekly UT

Russell

Daily DT, Weekly DT

Potential resistance around 1,240, 1,259, 1,287, 1,296, 1,341, 1,388, 1,420

20 Apr, Mon

BDI closed higher while Harpex closed lower.

Dollar Index consolidating since mid of Mar.

Instruments that show buying interest (3) from Dealer/Intermediary (sell-side participants)

UT

- None

- None

- Dow (1)

- S&P (1)

- Russell (1)

Instruments that show selling interest at extreme (2) by Dealer/Intermediary (sell-side participants)

UT

- None

- None

- None

(1) COT Index >= 90, Buying interest at extreme

(2) COT Index <= 10, Selling interest at extreme

(3) COT Index >= 70, rising COT Index, monitor for trend reversal

Down Trend and Up Trend is based on 50 Simple Moving Average(2) COT Index <= 10, Selling interest at extreme

(3) COT Index >= 70, rising COT Index, monitor for trend reversal

Dow

Daily DT, Weekly DT

Potential resistance around 24,837, 25,326, 25,645, 25,784, 26,245, 26,627

Potential resistance around 24,837, 25,326, 25,645, 25,784, 26,245, 26,627

Potential support around 24,170, 23,567, 23,435, 23,175, 22,776, 22,121, 22,027, 21,659, 21,099

S&P

Daily DT, Weekly DT

Potential resistance around 2,940, 2,983, 3,022, 3,072, 3,155, 3,219

Potential support around 2,874, 2,854, 2,825, 2,814, 2,786, 2,747, 2,710, 2,593, 2,551, 2,506, 2,480

Nasdaq

Daily DT, Weekly UT

Potential resistance around 9,243, 9,653, 9,723, 9,873, 10,595

Potential support around 8,781, 8,428, 8,196, 8,002, 7,859, 7,706, 7,516, 7,282, 7,134

Russell

Daily DT, Weekly DT

Potential resistance around 1,240, 1,259, 1,287, 1,296, 1,341, 1,388, 1,420

Potential support around 1,213, 1,185, 1,164, 1,137, 1,114, 1,095

Key event to watch out (SG Time, GMT+8)

- 0645 New Zealand CPI (QoQ) (Q1)

- 0930 China PBoC Loan Prime Rate

- 0930 Australia RBA Meeting Minutes

- 1300 Australia RBA's Governor Lowe speech

- 1400 UK Average Earnings Index +Bonus (Feb)

- 1400 UK Claimant Count Change (Mar)

- 1700 German ZEW Economic Sentiment (Apr)

- 2030 Canada Core Retail Sales (MoM) (Feb)

- 2200 US Existing Home Sales (Mar)

- 1400 UK CPI (YoY) (Mar)

- 2030 Canada Core CPI (MoM) (Mar)

- 2230 US Crude Oil Inventories

- 1400 UK Retail Sales (MoM) (Mar)

- 1530 German Manufacturing PMI (Apr)

- 1600 Europe Markit PMI Composite

- 1630 UK Composite PMI

- 1630 UK Manufacturing PMI

- 1630 UK Services PMI

- 2030 US Initial Jobless Claims

- 2200 US New Home Sales (Mar)

- 1400 UK Retail Sales (MoM) (Mar)

- 1600 German Ifo Business Climate Index (Apr)

- 2030 US Core Durable Goods Orders (MoM) (Mar)

- 2200 US Michigan Consumer Sentiment Index

Subscribe to:

Comments (Atom)