US market broke hlf (higher low formation) on the weekly chart. US market has recovered some of the losses before closing lower.

Nasdaq is consolidating between 14,178 and 14,846.

Russell is consolidating between 2,084 and 2,368.

Harpex, BDI, CCFI and CDFI closed higher.

The dollar index closed above 93.3 resistance level.

Watch out for

- PMI and GDP Data from various countries

- Fed's Chair Powell speech

- Jackson Hole Symposium

Instruments that show buying interest (3) from Dealer/Intermediary (sell-side participants)

UT

Neutral

DT

Instruments that show selling interest at extreme (2) by Dealer/Intermediary (sell-side participants)

UT

Neutral

DT

Note

(1) COT Index >= 90, Buying interest at extreme

(2) COT Index <= 10, Selling interest at extreme

(3) COT Index >= 70, rising COT Index, monitor for trend reversal

Down Trend and Up Trend is based on 50 Simple Moving Average

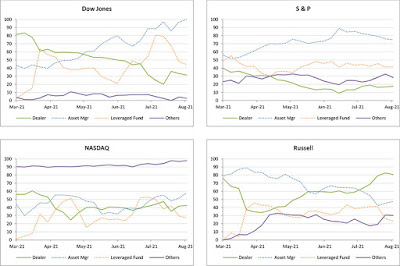

Dow

Daily UT, Weekly UT

Potential resistance around 35,495, 37,625

Potential support around 33,365, 31,236, 29,407, 29,106, 28,912

S&P

Daily UT, Weekly UT

Potential resistance around 4,632

Potential support around 4,396, 4,161, 3,925, 3,690, 3,579, 3,454

Nasdaq

Daily UT, Weekly UT

Potential resistance around 15,652

Potential support around 114,930, 4,207, 13,485, 12,762, 12,410, 12,040

Russell

Daily DT, Weekly UT

Potential resistance around 2,170, 2,300, 2,430, 2,561

Potential support around 2,040, 1,910, 1,779, 1,743, 1,708

Key event to watch out for (SG Time, GMT+8)

23 Aug, Mon

- 0930 Australia Retail Sales s.a. (MoM)

- 1530 German Manufacturing PMI (Aug)

- 1600 Europe Markit PMI Composite

- 1630 UK Services PMI (Aug)

- 2200 US Existing Home Sales (Jul)

24 Aug, Tue

- 0645 New Zealand Retail Sales (QoQ)

- 1400 German GDP (QoQ) (Q2)

- 2200 US New Home Sales (Jul)

25 Aug, Wed

- 1600 German Ifo Business Climate Index (Aug)

- 2030 US Core Durable Goods Orders (MoM) (Jul)

- 2230 US Crude Oil Inventories

26 Aug, Thu

- 1930 Europe ECB Publishes Account of Monetary Policy Meeting

- 2030 US GDP (QoQ) (Q2)

- 2030 US Initial Jobless Claims

27 Aug, Fri

- 0800 US Jackson Hole Symposium

- 0930 Australia Retail Sales (MoM) (Jul)

- 2030 US Goods Trade Balance

- 2200 US Michigan Consumer Sentiment Index

- 2200 US Fed's Chair Powell speech

28 Aug, Sat

- 0800 US Jackson Hole Symposium