The dollar index broke and closed above 103.6 resistance.

Resistance at TLU2, TLU1, 106.7, 109.7

Support at 103.6, 102.3, 100.3, 99.8, 98.7

Sunday, May 28, 2023

Dollar Index closed higher

Commodities Update 27 May 2023

BDI slumped further from 1,384 (19 May) to 1,172 (26 May)

Harpex remained the same at 1,238 (26 May)

CDFI closed lower from 1,031.82 (19 May) to 985.38 (26 May)

CCFI closed lower from 946.18 (19 May) to 938.74 (26 May)

COT

Down Trend

- Copper

- Wheat (1)

- Soybean Oil (1)

- Soybeans (1)

- Corn

- Heating Oil

- Gasoline (1)

- Palladium (1)

- Cotton

- Gold

- Silver

Up Trend

- Cocoa

- None

- None

Note

(1) COT Index >= 90, Buying interest at extreme

(2) COT Index <= 10, Selling interest at extreme

(3) COT Index >= 70, rising COT Index, monitor for a trend reversal

Down Trend and Up Trend are based on 50 Simple Moving Average.

US Markets 27 May 2023

The US market closed mixed. Dow and Russell closed lower while consolidating. S&P broke pwl (previous week's low) and recovered to close higher, testing yearly high. Nasdaq continues to close higher.

BDI, CCFI and CDFI closed lower, while Harpex remained the same.

The dollar index broke and closed above 103.6 resistance.

Watch out for

- Multiple countries reporting Manufacturing PMI and CPI

- US NFP

- Dow

- S&P

- None

- None

Instruments that show selling interest at extreme (2) by Dealer/Intermediary (sell-side participants)

UT

- Nasdaq

- None

- None

(2) COT Index <= 10, Selling interest at extreme

(3) COT Index >= 70, rising COT Index, monitor for trend reversal

Dow

Daily UT, Weekly UT

Potential resistance around 33,365, 35,495, 37,625, 39,754

Potential support around 31,236, 29,106, 26,976

Daily UT, Weekly UT

Nasdaq

Daily UT, Weekly UT

Daily UT, Weekly DT

Potential resistance around 1,779, 1,910, 2,040, 2,170, 2,300

Key event to watch out for (SG Time, GMT+8)

29 May, Mon

- UK, US and Switzerland on holiday

- No important data

30 May, Tue

- 2200 US CB Consumer Confidence (May)

31 May, Wed

- 0930 China Manufacturing PMI (May)

- 1555 German Unemployment Change (May)

- 2000 German CPI (MoM) (May)

- 2030 Canada GDP Growth Rate QoQ (Q1)

- 2200 US JOLTs Job Openings (Apr)

01 Jun, Thu

- 0930 Australia Retail Sales (MoM)

- 0945 China Caixin Manufacturing PMI (May)

- 1555 German Manufacturing PMI (May)

- 1600 Europe Manufacturing PMI (May)

- 1630 UK Manufacturing PMI (May)

- 1700 Europe CPI (YoY) (May)

- 1930 Europe ECB Publishes Account of Monetary Policy Meeting

- 2015 US ADP Nonfarm Employment Change (May)

- 2030 US Initial Jobless Claims

- 2200 US ISM Manufacturing PMI (May)

- 2300 US Crude Oil Inventories

02 Jun, Fri

- 2030 US Average Hourly Earnings (MoM) (May)

- 2030 US Nonfarm Payrolls (May)

- 2030 US Unemployment Rate (May)

Sunday, May 21, 2023

Dollar Index closed higher

The dollar index continues to close higher after it broke out last week.

Resistance at 103.6, TLU2, TLU1, 106.7, 109.7

Support at 102.3, 100.3, 99.8, 98.7

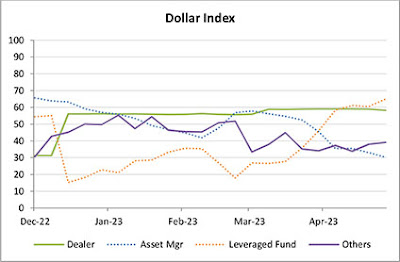

COT for Dollar Index

Weekly chart with 50 SMA

Commodities Update 20 May 2023

BDI slumped down from 1,558 (12 May) to 1,384 (19 May)

Harpex edged lower from 1,239 (12 May) to 1,238 (19 May)

CDFI closed lower from 1,072.70 (12 May) to 1,031.82 (19 May)

CCFI closed lower from 955.93 (12 May) to 946.18 (19 May)

COT

Down Trend

- Copper

- Wheat

- Soybean Oil (1)

- Soybeans (1)

- Corn

- Gasoline (1)

- Heating Oil

- Cotton

- Palladium

- Gold

Up Trend

- Cocoa

- None

- None

Note

(1) COT Index >= 90, Buying interest at extreme

(2) COT Index <= 10, Selling interest at extreme

(3) COT Index >= 70, rising COT Index, monitor for a trend reversal

Down Trend and Up Trend are based on 50 Simple Moving Average.

US Markets 20 May 2023

The US market closed higher while consolidating, except Nasdaq broke out and closed above consolidation resistance.

Harpex, BDI, CCFI and CDFI closed lower.

The dollar index continues to close higher after it broke out last week.

Watch out for

- Multiple countries reporting Manufacturing PMI

- China and New Zealand Interest Rate Decision

- FOMC Meeting Minutes

- Dow

- S&P

- None

- None

Instruments that show selling interest at extreme (2) by Dealer/Intermediary (sell-side participants)

UT

- None

- None

- None

(2) COT Index <= 10, Selling interest at extreme

(3) COT Index >= 70, rising COT Index, monitor for trend reversal

Dow

Daily UT, Weekly UT

Potential resistance around 35,495, 37,625, 39,754

Potential support around 33,365, 31,236, 29,106, 26,976

Daily UT, Weekly UT

Nasdaq

Daily UT, Weekly UT

Daily DT, Weekly DT

Potential resistance around 1,779, 1,910, 2,040, 2,170, 2,300

Key event to watch out for (SG Time, GMT+8)

- Canada on holiday

- 0915 China PBoC Loan Prime Rate

- 1530 German Manufacturing PMI (May)

- 1600 Europe Manufacturing PMI (May)

- 1630 UK Manufacturing PMI (May)

- 2145 US Services PMI (May)

- 2200 US New Home Sales (Apr)

- 1000 New Zealand RBNZ Interest Rate Decision

- 1400 UK CPI (YoY) (Apr)

- 1600 German Ifo Business Climate Index (May)

- 2230 US Crude Oil Inventories

- 0200 US FOMC Meeting Minutes

- 1400 German GDP (QoQ) (Q1)

- 2030 US GDP (QoQ) (Q1)

- 2030 US Initial Jobless Claims

- 2200 US Pending Home Sales (MoM) (Apr)

- Hong Kong on holiday

- 0930 Australia Retail Sales (MoM) (Apr)

- 1400 UK Retail Sales (MoM) (Apr)

- 2030 US Core Durable Goods Orders (MoM) (Apr)

- 2030 US Core PCE Price Index (MoM) (Apr)

- 2200 US Michigan Consumer Sentiment (May)

Sunday, May 14, 2023

Dollar Index closed higher

The dollar index broke and closed above consolidation resistance.

Resistance at 103.6, TLU2, TLU1, 106.7, 109.7

Support at 102.3, 100.3, 99.8, 98.7

COT for Dollar Index

Weekly chart with 50 SMA

Commodities Update 13 May 2023

BDI remained the same at 1,558 (12 May)

Harpex closed higher from 1,226 (05 May) to 1,239 (12 May)

CDFI closed lower from 1,077.59 (05 May) to 1,072.70 (12 May)

CCFI closed lower from 967.58 (05 May) to 955.93 (12 May)

COT

Down Trend

- Copper

- Wheat (1)

- Soybean Oil (1)

- Soybeans

- Corn

- Cotton (1)

- Heating Oil

- Gasoline

- Palladium (1)

- Gold

Up Trend

- Cocoa

- None

- None

Note

(1) COT Index >= 90, Buying interest at extreme

(2) COT Index <= 10, Selling interest at extreme

(3) COT Index >= 70, rising COT Index, monitor for a trend reversal

Down Trend and Up Trend are based on 50 Simple Moving Average.

US Markets 13 May 2023

The US market closed lower with an inside day on the weekly chart, except Nasdaq closed higher.

While Harpex closed higher, CCFI and CDFI closed lower, with no change in BDI.

The dollar index broke consolidation support.

Watch out for

- CPI and Sales data from multiple countries

- Speech by UK BoE Gov Bailey and US Fed Chair Powell

- Dow

- S&P

- None

- None

Instruments that show selling interest at extreme (2) by Dealer/Intermediary (sell-side participants)

UT

- None

- None

- None

(2) COT Index <= 10, Selling interest at extreme

(3) COT Index >= 70, rising COT Index, monitor for trend reversal

Dow

Daily UT, Weekly Neutral

Potential resistance around 33,365, 35,495, 37,625, 39,754

Potential support around 31,236, 29,106, 26,976

Daily UT, Weekly Neutral

Nasdaq

Daily UT, Weekly Neutral

Daily DT, Weekly DT

Potential resistance around 1,779, 1,910, 2,040, 2,170, 2,300

Key event to watch out for (SG Time, GMT+8)

15 May, Mon

- No important data

16 May, Tue

- 0930 Australia RBA Meeting Minutes

- 1000 China Industrial Production (YoY) (Apr)

- 1400 UK Average Earnings Index +Bonus (Mar)

- 1400 UK Claimant Count Change (Apr)

- 1700 German ZEW Economic Sentiment (May)

- 2030 US Core Retail Sales (MoM) (Apr)

- 2030 US Retail Sales (MoM) (Apr)

- 2030 Canada Core CPI (MoM) (Apr)

- 2200 Europe ECB President Lagarde Speaks

17 May, Wed

- 0750 Japan GDP Growth Rate QoQ (Q1)

- 1700 Europe CPI (YoY) (Apr)

- 1750 UK BoE Gov Bailey Speaks

- 2030 US Building Permits (Apr)

- 2230 US Crude Oil Inventories

18 May, Thu

- Switzerland on holiday

- 0930 Australia Employment Change (Apr)

- 1000 New Zealand Annual Budget Release

- 2030 US Initial Jobless Claims

- 2030 US Philadelphia Fed Manufacturing Index (May)

- 2200 US Existing Home Sales (Apr)

19 May, Fri

- 0730 Japan Inflation Rate YoY (Apr)

- 2030 Canada Retail Sales YoY (Mar)

- 2300 US Fed Chair Powell Speaks

Sunday, May 7, 2023

Dollar Index closed lower

The dollar index closed lower while consolidating.

Resistance at 102.3, 103.6, TLU2, TLU1, 106.7, 109.7

Support at 100.3, 99.8, 9

COT for Dollar Index

Weekly chart with 50 SMA

Commodities Update 06 May 2023

BDI closed lower from 1,576 (28 Apr) to 1,558 (05 May)

Harpex closed higher from 1,217 (28 Apr) to 1,226 (05 May)

CDFI closed lower from 1,103.26 (28 Apr) to 1,077.59 (05 May)

CCFI closed higher from 964.49 (28 Apr) to 967.58 (05 May)

COT

Down Trend

- Copper

- Wheat (1)

- Soybean Oil (1)

- Soybeans

- Corn

- Cotton (1)

- Heating Oil

- Palladium (1)

- Gasoline

- Gold

Up Trend

- Cocoa

- None

- None

Note

(1) COT Index >= 90, Buying interest at extreme

(2) COT Index <= 10, Selling interest at extreme

(3) COT Index >= 70, rising COT Index, monitor for a trend reversal

Down Trend and Up Trend are based on 50 Simple Moving Average.

US Markets 06 May 23

The US market is consolidating. Dow, S&P and Russell closed lower, while Nasdaq closed higher. Dow and S&P closed with an outside day on the weekly chart.

While Harpex and CCFI closed higher, BDI and CDFI closed lower.

The dollar index closed lower while consolidating.

Watch out for

- Interest rate decisions from the UK

- CPI data from multiple countries

- Dow

- S&P

- None

- None

Instruments that show selling interest at extreme (2) by Dealer/Intermediary (sell-side participants)

UT

- None

- None

- None

(2) COT Index <= 10, Selling interest at extreme

(3) COT Index >= 70, rising COT Index, monitor for trend reversal

Dow

Daily UT, Weekly Neutral

Potential resistance around 35,495, 37,625, 39,754

Potential support around 33,365, 31,236, 29,106, 26,976

Daily UT, Weekly Neutral

Nasdaq

Daily UT, Weekly Neutral

Daily DT, Weekly DT

Potential resistance around 1,779, 1,910, 2,040, 2,170, 2,300

Key event to watch out for (SG Time, GMT+8)

08 May, Mon

- Holiday for UK

- No important data

09 May, Tue

- 0930 Australia Retail Sales (MoM)

10 May, Wed

- 1400 German CPI (MoM) (Apr)

- 2030 US Core CPI (MoM) (Apr)

- 2030 US CPI (MoM) (Apr)

- 2230 US Crude Oil Inventories

11 May, Thu

- 0930 China Inflation Rate YoY (Apr)

- 1900 UK BoE Interest Rate Decision (May)

- 2030 US Initial Jobless Claims

- 2030 US PPI (MoM) (Apr)

- 2115 UK BoE Gov Bailey Speaks

12 May, Fri

- 1400 UK GDP (MoM) (Mar)

- 2200 US Michigan Consumer Sentiment (May)